inherited annuity taxation irs

A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars. If you inherit this type.

Www Irs Gov Pub Irs Pdf P334 Pdf Irs Tax Guide Irs Taxes

Ad Contact Haynes Tax Law Now.

. Ad Contact Haynes Tax Law Now. However there are no RMD issues and you wont have that 10 early. But there is no 10 early withdrawal penalty to worry about and you dont have to.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. So for instance if the annuity has 50000 in gains and 50000 in principal you wont receive the tax-free principal until after youve received all of the gains. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

Tax-deferred means you will pay ordinary income tax on the earnings portions of your distributions. An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. Inherited from spouse.

In many cases the IRS requires the first payment from an inherited IRA to be made by December 31 of the calendar year following the owners death. In other words you have to pay ordinary income tax on the earnings part of your distributions. These annuities have already been subject to income tax however any.

Treat it as his or her own IRA by designating. Because the money you use to fund the annuity has already been taxed you can withdraw your principal tax-free early withdrawals may be subject to the IRS penalty tax andor. However any interest thats been earned will be taxed once withdrawn.

Dont Face The IRS Alone. In turn taxation of annuity distributions. If you work for a public school or certain tax-exempt organizations you may be eligible to participate in a 403b retirement plan offered by your.

Any beneficiary including spouses can choose to take a one-time lump sum payout. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Ad Learn More about How Annuities Work from Fidelity.

Dont Face The IRS Alone. The first payment from an inherited non. The reason is that these annuities have already been subject to income tax.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. The earnings are taxable over the life of the payments. You have an annuity purchased for 50000 with after-tax money.

An annual payment of 5000 10 percent of your. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket. Tax-sheltered annuity plans 403b plans.

Either way you will pay regular taxes only on the interest. In this case taxes are owed on the entire difference between what the original owner paid for the. Ad Learn More about How Annuities Work from Fidelity.

If a traditional IRA is inherited from a spouse the surviving spouse generally has the following three choices. At retirement you have a life expectancy of 10 years. How taxes are paid on an.

Accident An Unfortunate Incident That Happens Unexpectedly And Unintentionally Explore More Http Www M Annuity Life Insurance Companies Term Life Insurance

Form 1099 R Instructions Information Community Tax

Annuity Beneficiaries Inheriting An Annuity After Death

3 11 3 Individual Income Tax Returns Internal Revenue Service

Qualified Vs Non Qualified Annuities Taxation And Distribution

Withdrawing Money From An Annuity How To Avoid Penalties

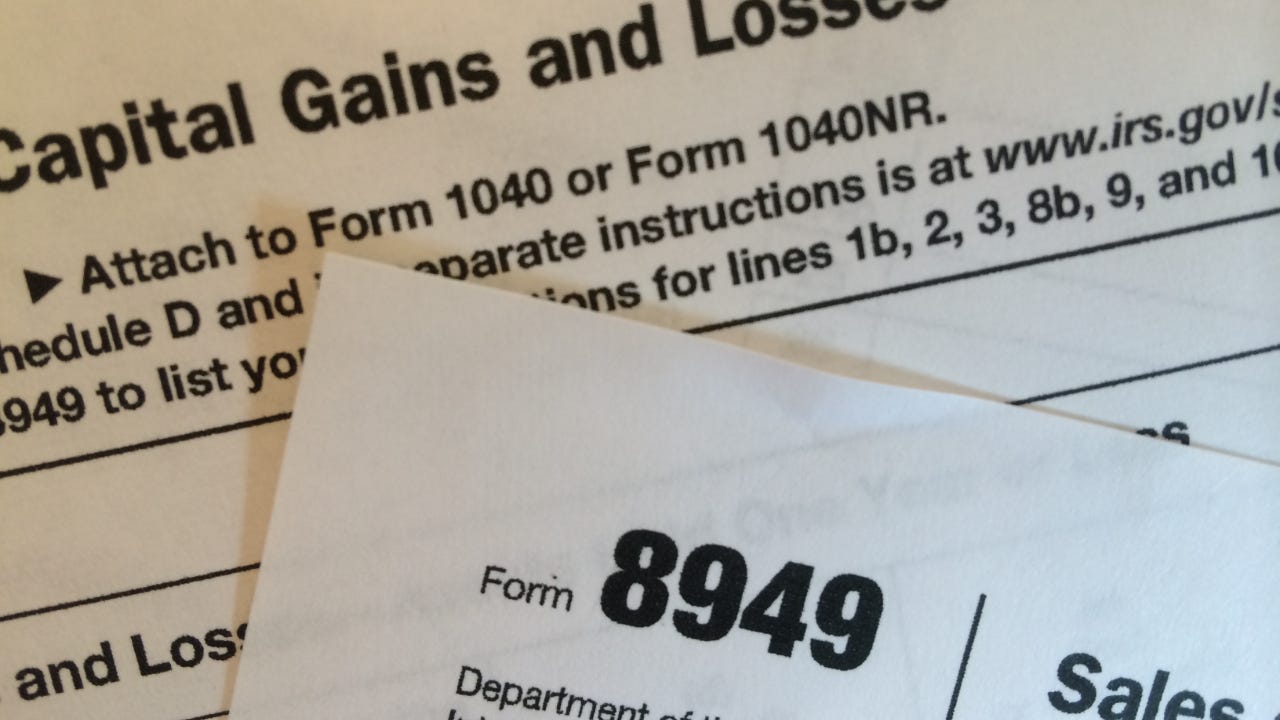

How To Deduct Stock Losses From Your Taxes Bankrate

The 6 Types Of Itemized Deductions That Can Still Be Claimed After Tcja Https Www Kitces Com Blog Itemized Deducti Deduction Inherited Ira Standard Deduction

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Annuity Taxation How Various Annuities Are Taxed

Annuity Exclusion Ratio What It Is And How It Works

Annuity Taxation How Various Annuities Are Taxed

Taxation Of Annuities Ameriprise Financial

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Form 5329 Instructions Exception Information For Irs Form 5329