are union dues tax deductible in california

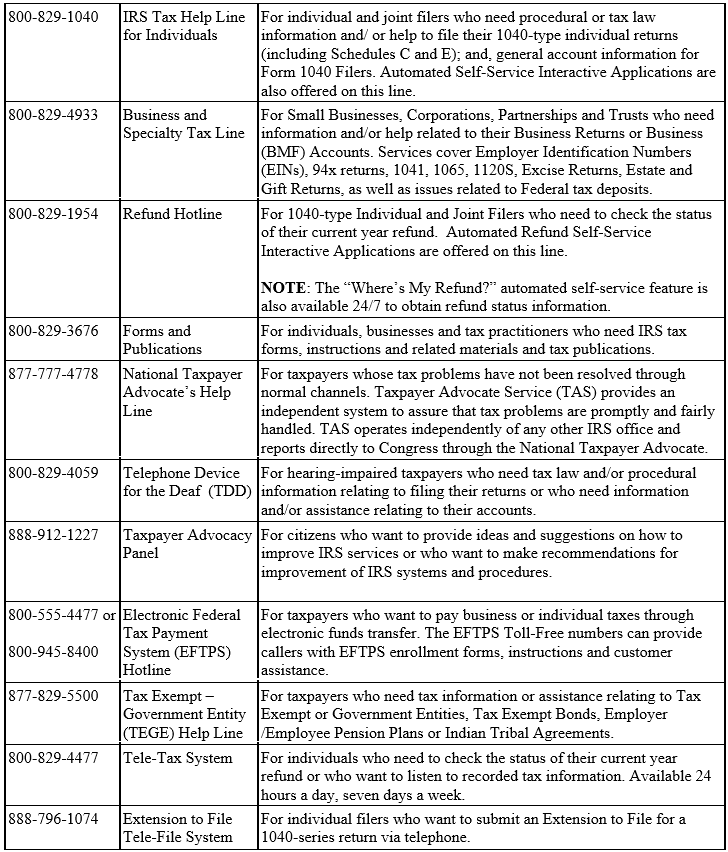

Web If you belong to a union or professional organization you can deduct certain types of union dues or professional membership fees from your income tax. Web For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

Union Dues Are Now Tax Deductible Foa Law

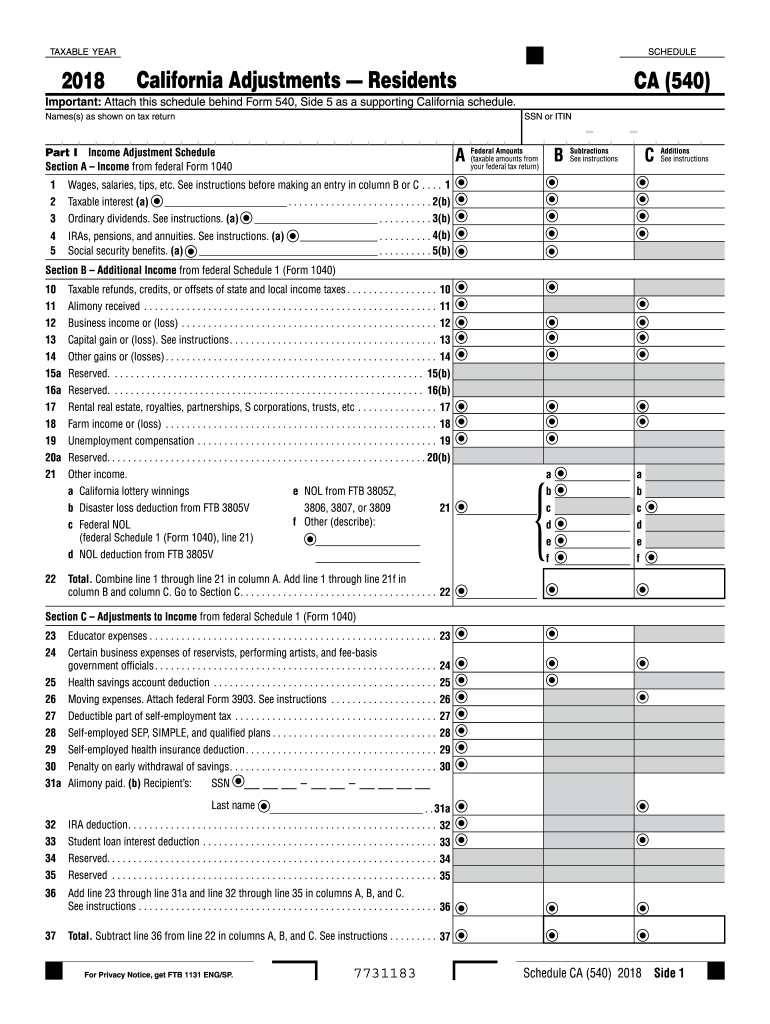

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form.

. Web The union is responsible for processing all requests and the employer must rely on the information provided by the union regarding whether dues deductions were. Web This bill would allow taxpayers a deduction of union dues paid in calculating their AGI. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to.

Web For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Supreme Court ruled in a 5-4 decision that labor unions can no longer require non-member public employees to pay agency fees thus overruling the. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form.

For tax years 2018 through 2025 union dues and all. Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues. It was supported by PORAC and AFL-CIO but.

Web You can deduct dues and initiation fees you pay for union membership. As part of the new state budget recently. Web The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44.

You cannot deduct union dues on your state return. SOLVED by TurboTax 2961 Updated 5 days ago. Current state law already allows taxpayers to deduct their union dues paid as a.

You may claim a tax deduction on line 21200 of your tax return. Web By Isabel Blank September 7 2022 News. Web On June 27 2018 the US.

Web California is one of only a handful of states where union dues are tax deductible for state income tax purposes. 2577 would have allowed union members in California to deduct their dues on their state personal income tax. Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR.

You can deduct dues and initiation fees you pay for union membership. Enter your income from. Web If California moves to enact future legislation it will change Californias tax deduction for union members into a tax credit meaning taxpayers would be.

Web As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their. Only unreimbursed expenses for books. California follows the federal rule.

Line 21200 was line 212 before tax year 2019. Web Deductions expressly authorized in writing by the employee to cover insurance premiums hospital or medical dues or other deductions not amounting to a rebate or deduction. Web Do teacher union dues qualify for the Educator Expense deduction.

Employees Can Deduct Workplace Expenses For Tax Years Prior To 2018 Turbotax Tax Tips Videos

Tax Write Offs For Athletes Awm Capital Awm Capital

Gavin Newsom Is Praised For Nation S First Union Dues Tax Credit But It S Not A Done Deal

California Governor Gavin Newsom Signs New Budget Creating Nation S First Tax Credit For Union Dues

Historic Tax Benefit For Union Workers Championed By Udw Signed Into Law Udw Fighting For Workers And Our Communities Udw Fighting For Workers And Our Communities

Ca Tax Rate Schedule 2017 Fill Out Sign Online Dochub

California Tax Boutique Personal Taxes

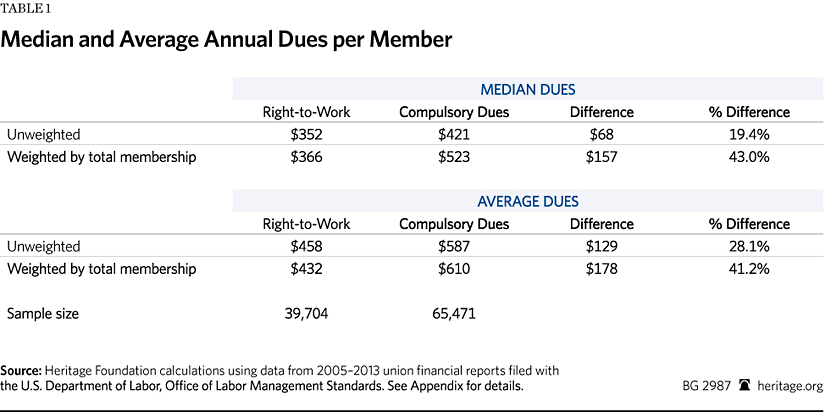

Unions Charge Higher Dues And Pay Their Officers Larger Salaries In Non Right To Work States The Heritage Foundation

Why All Workers Should Be Able To Deduct Union Dues Center For American Progress

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Union Station California S Workers Tax Fairness Credit Would Be The First Tax Credit For Union Dues In The U S Ballotpedia News

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

It S Tax Time Remember Union Membership Dues May Be Deductible Nteu Chapter 280 U S Epa Hq

Gov Newsom Pays Unions Back For Recall Rescue California Globe

California Union Forges Another Signature To Keep A Member Locked Into Paying Dues

California Child Support Guide Lawsuit Org

Ca Tax Rate Schedule 2017 Fill Out Sign Online Dochub

Ca Tax Credit For Union Dues Awaits Gavin Newsom S Signature The Sacramento Bee

Udw Wins Historic Tax Benefit For California Workers Udw Fighting For Workers And Our Communities Udw Fighting For Workers And Our Communities